- Social Leverage Weekly

- Posts

- Social Leverage Letter | Issue #39

Social Leverage Letter | Issue #39

Taking the Downturn Seriously, Deal Flow & Crypto Corner

A weekly newsletter for early-stage seed startups and investors.

Was this email forwarded to you? Sign up here.

UPFRONT

Social Leverage portfolio company (Fund III) Staytuned has completed the acquisition of Moonship, a Shopify app that creates AI-based personalized discounts.

Details: Moonship was founded in November of 2020 to help Shopify merchants convert reluctant buyers browsing their online stores. The purpose-built app will help Staytuned customers profitably and effortlessly scale their businesses.

Increases revenue with one-time personalized pop-up discount codes tailored to customers site interaction.

Conversions increased 20 to 30 percent for those merchants deploying Moonship.

Merchants can install, customize, and go live with the app in minutes.

Why it matters: DTC operators require new channels to grow sales with merchant-friendly tools that can unlock additional revenue. Top merchants like Aura Bora, ILYSM, and Nutracelle have already experienced an uplift in revenue within days of installing Moonship.

The bottom line: Moonship is the best product of its kind in the ecosystem and allows merchants to offset the growing costs of paid marketing while diversifying growth channels.

Another way @staytuned_digi can increase your revenue if your a @Shopify merchant. Our tool kit keeps growing.

— Serge Kassardjian (@sergekass)

11:23 PM • May 25, 2022

READING

Sequoia Capital is warning founders not to expect the recovery from the current downturn to happen quickly and are providing portfolio companies advice on how to avoid the “death spiral”. The combination of turbulent markets, inflation, and geopolitical conflict is a “crucible moment” of uncertainty which requires founders to move fast and cut costs.

WHAT ELSE WE'RE READING

Here's a few other stories that caught our eye over the past week.

Crisis Management: Resilience as a Force Multiplier

The Worst Time to Look for an Idea

Under The Hood: Qualcomm Ventures Looks To 5G, IoT And Metaverse To Grow Ecosystem

The Tech Crash Could Be a Talent Bonanza for Big Tech

LISTENING

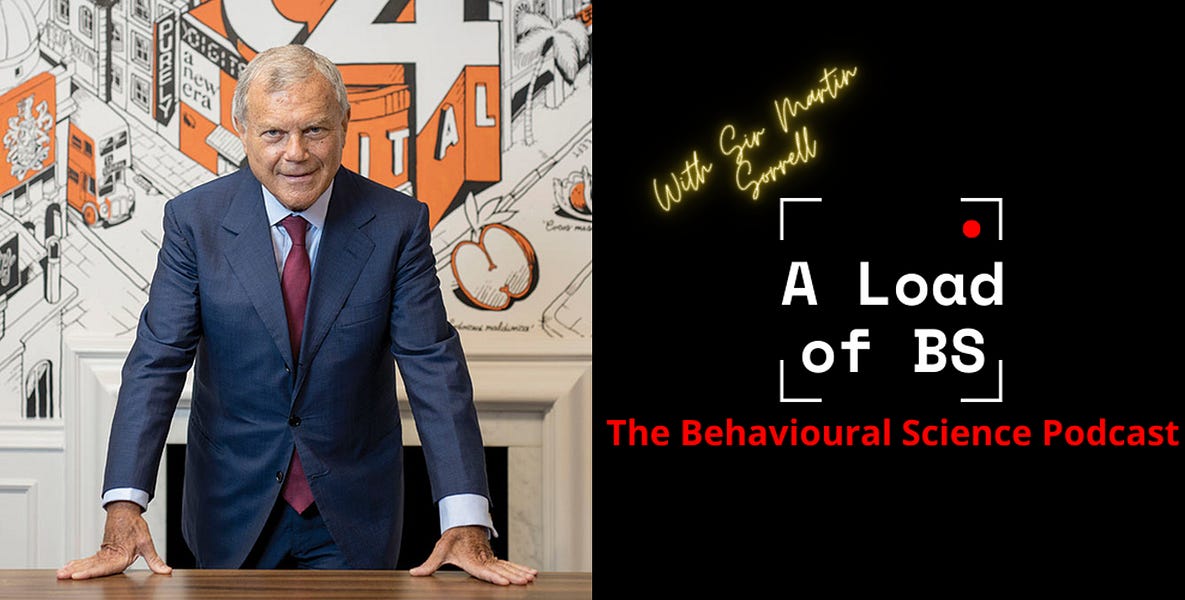

Sir Martin Sorrell has been a titan of global capitalism over the last 40 years. He made his name building WPP into an advertising juggernaut, and went on to found S4 Capital. At 77 years old, Sir Martin is showing no signs of slowing down.

WHAT ELSE WE'RE LISTENING TO

A few more podcasts you might like:

Mike Dudas of 6th Man Ventures on Crypto, LinksDAO, and Applying a DAO Model to Biotech (Panic with Friends)

Edward O. Thorp, A Man for All Markets — Beating Blackjack and Roulette, Beating the Stock Market, Spotting Bernie Madoff Early, and Knowing When Enough Is Enough (The Tim Ferriss Show)

Smart Managers Don’t Compare People to the “Average” (HBR IdeaCast)

Peter Saddington — Love of Learning (Infinite Loops)

DEAL FLOW

The latest venture funding from around the globe:

Digital Investing Platform Bibit Raises Over $80M in Funding

8vdX raises $3M in seed round from Y Combinator, others

Sports betting ratings agency SharpRank raises $2.5M in latest seed round

Clozd Raises $52M in Series A Funding

Slip.stream Raises Additional $7.5M in Series A Funding from Sony Music Entertainment, Third Prime, and LightShed Ventures

CRYPTO CORNER

News on Crypto/web3:

Crypto players take over main strip in Davos even after market crash

Once Immune From Crypto Winter, Bored Apes Are Feeling the Cold

Smart Money is betting big on web3, layer 2

What Leaders Need To Know About Blockchain

How DAOs will transform the future of web3

JOB BOARD

Explore openings at our portfolio companies:

Featured Jobs:

Check out all of our portfolio companies at Social Leverage.

© 2017-2021 All Rights Reserved, Social Leverage LLC.

Affiliate Disclosure: Social Leverage Group, LLC ("SLG"), Social Leverage Capital Fund I, LP ("SLC"), Social Leverage Capital Fund II, LP ("SLCII"), Social Leverage Capital Fund III, LP ("SLCIII") and Social Leverage Capital Fund IV, LP ("SLCIV") are all distinct entities from Social Leverage, LLC ("SL"). Social Leverage is not a registered investment advisor. SLC, SLCII, SLCIII, SLCIV, SLG and SL have used the logo and branding of Social Leverage with the permission of Social Leverage Group, LLC.